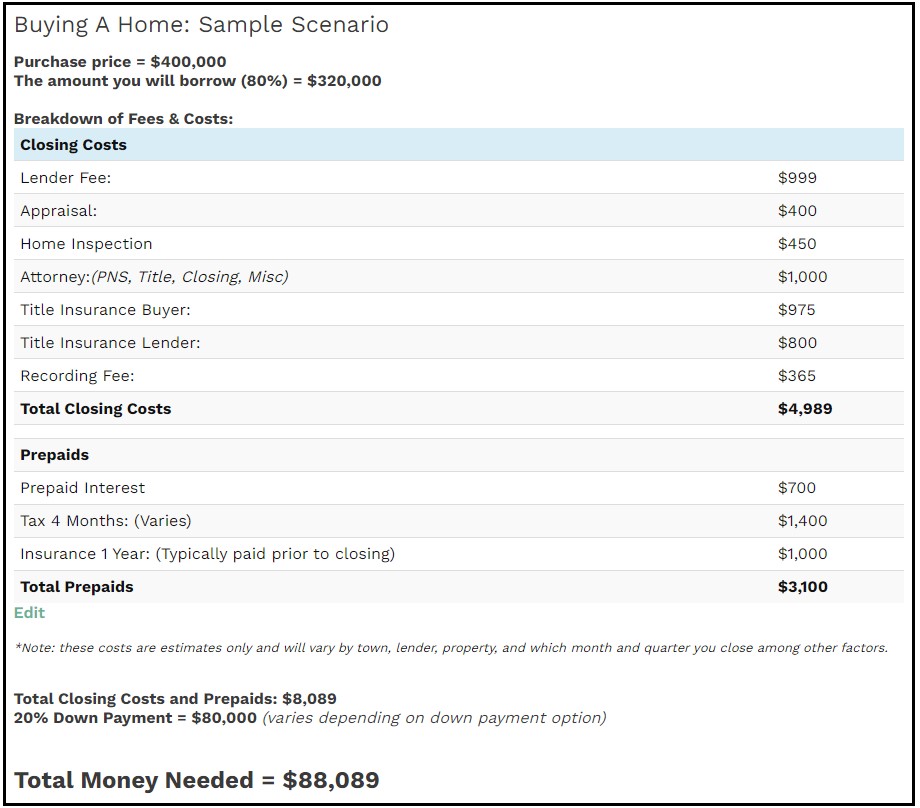

One of the most common questions that we are asked is how much money a prospective home buyer needs to have on hand before buying a home. The actual down payment can vary anywhere from 3% down up to 20% or more depending on what program or type of mortgage loan the buyer chooses. Here we take a closer look at what you as a buyer should expect when you go through the process of buying a home.

Common Home Mortgage Options

When you want to apply for a mortgage loan to purchase a home you certainly don’t need to have 20% down. There are many options available depending on your needs. Many mortgage loans have low and no down payment options including:

- Conventional Fannie Mae/Freddie Mac Loans

- Jumbo Loans

- VA Loans

- FHA Loans

- MassHousing Loans

- New Hampshire Housing Loans

- USDA Loans

- 203K and Streamlined 203 K Loans

- Adjustable Rate Mortgages

There are also mortgage programs available for buyers who are considering alternative options including:

- Buydowns (3-2-1, 2-1, 1-0)

- Assumable Mortgages

Lender and Attorney Costs When Purchasing a Home

Lender Fee:

The first item on this list is the Lender Fee. These are fees that lenders charge you for doing the work that they do in terms of processing and approving the loan.

Appraisal Cost:

A home appraisal is a professional examination of your home done by a licensed appraiser who specializes in examining homes and determining a value.

Home Inspection:

This is a fee paid to a licensed home inspector to come in and perform a home inspection, where the property is evaluated for potential problems such as building codes, along with other issues the property may have in terms of needed repairs. It is important to get this done so that you are not surprised by costly repairs later on, and your lender will want to make sure there are no safety hazards that could result in a lawsuit if someone falls or gets hurt on your property. This fee is paid at the time of the inspection directly to the inspector.

Attorney Fee:

As CEO Anthony Lamacchia will attest, it is crucial to have a good real estate attorney when buying a home. Buying a home is usually the biggest financial purchase of one’s life, so spending an extra $700 to $1,500 is money very well spent. A good attorney will make sure that all of the legal documentation is clear and correct, that all of the bases have been covered, and things that can help protect you are in place. Their work includes making sure that the title of your home is clear. The attorney will also handle negotiating the Purchase & Sale agreement that outlines exactly what is being bought and sold and has clauses that protect you as the buyer.

Title Insurance:

If you obtain a mortgage you will be required to purchase Title Insurance for the bank. This will protect you if something comes up later on which was not, for whatever reason, found during the attorney’s title examination. This can happen because of a problem with the records which are held at the Registry of Deeds or a similar office in your area, or because something comes up which was not previously known about. While rare, this can and has happened, so it is very important to make sure that the money you put into your house is not jeopardized. There is a reason why the mortgage lender will most likely require it, after all, because they understand just how critical protecting their investment is as well. As a buyer, you will also have the option to purchase owner’s title insurance as well which protects you from the same potential issues.

Recording Fee:

The Registry of Deeds will charge a recording fee. This fee is simply the cost you pay to have your new deed, mortgage, and all associated paperwork, officially entered into the permanent records of the city, town, and/or county in which you live, so that you are the legal owner of record of the property.

Prepaid Costs to be Aware of When Buying a Home

All prepaid costs can vary depending on when you close in the month for the mortgage interest and when you close in a quarter for the real estate taxes.

Pre-Paid Interest:

When a buyer buys a home the mortgage company requires them to pay the interest on the day of closing until the end of the current month. Then interest is paid in arrears thereafter. For example, if someone closes on February 15th they would have to pay the interest on the loan until February 28th, and then their first mortgage payment will be April 1st.

Pre-Paid Real Estate Taxes:

Taxes are paid in a similar fashion to the pre-paid interest except they are paid quarterly. So if a buyer closes on February 15th they would typically have to pay the taxes until March 31st which is the end of the first quarter.

Homeowners Insurance:

The last item is Homeowner’s insurance for the property, which covers major losses and other specific damage cases as outlined by the policy you choose. Lenders will require this to protect their investment in the form of the loan they made to you for the mortgage, but it’s really in your best interests to have it for obvious reasons as well. In most cases, the insurance company requires up-front payment for the first year, and it is typically paid prior to closing directly to the insurance company.

As you can see there are many costs to factor in when buying a home, and knowing how much cash you will need to have on hand when it comes time to actually close the deal is critical.