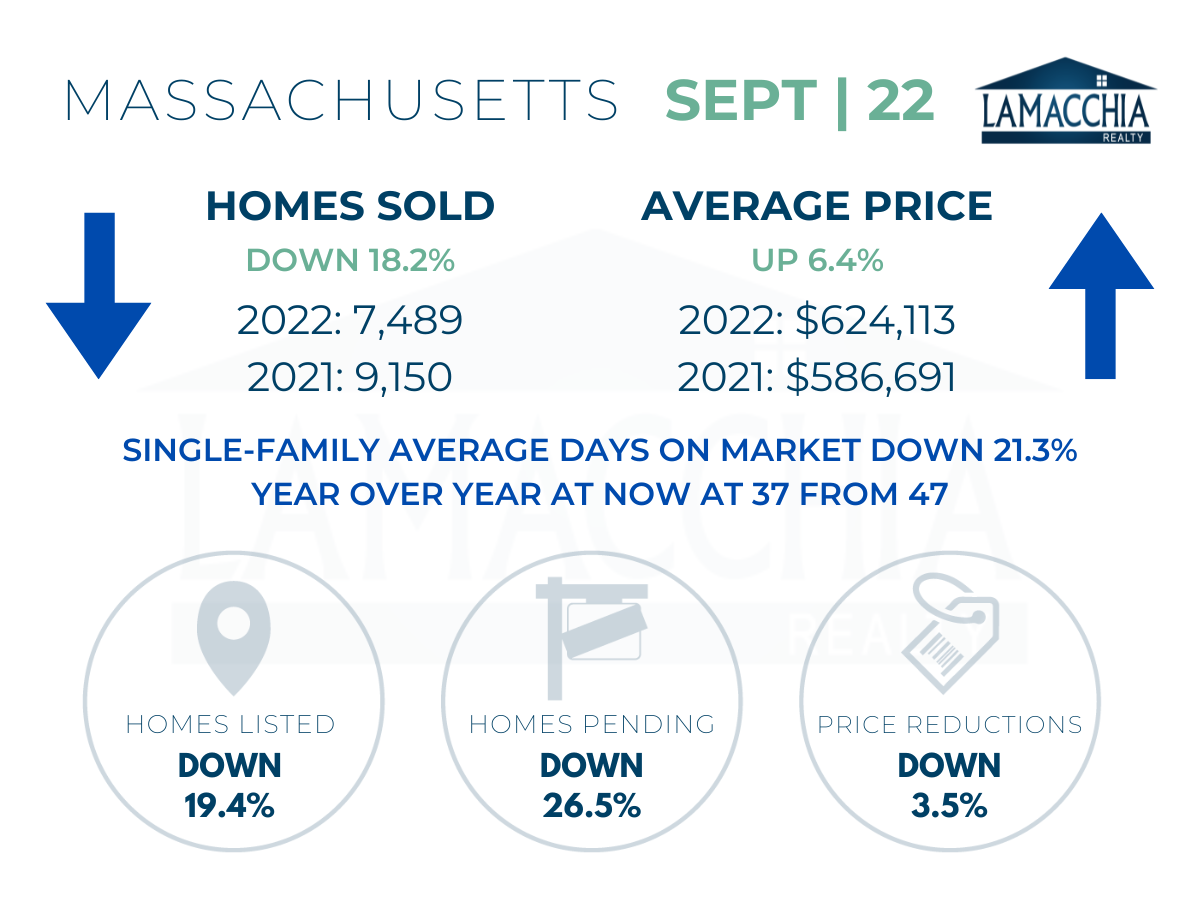

Massachusetts Home Sales Down 18.2%

Massachusetts Home Sales Down 18.2%

Sales are down 18.2% year over year with September 2022 at 7,489 over 9,150 last September. Sales are down across all categories.

- Single families: 5,771 (2021) | 4,877 (2022)

- Condominiums: 2,471 (2021) | 1,922 (2022)

- Multi-families: 908 (2021) | 690 (2022)

Average prices have continued their rise with another year-over-year increase of 6.4%, now at $624,113. Prices increased in every category.

- Single families: $636,911 (2021) | $698,938 (2022)

- Condominiums: $456,099 (2021) | $489,715 (2022)

- Multi-families: $671,940 (2021) | $664,226 (2022)

Homes Listed For Sale:

The number of homes listed is down by 19.4% when compared to September 2021 as would-be sellers are concerned about jumping into the market with all the rising rate headlines.

- 2022: 8,394

- 2021: 10,420

- 2020: 11,214

Pending Home Sales:

The number of homes placed under contract is down by 26.5% when compared to September 2021 which is an indicator that sales next month will likely fall.

- 2022: 6,572

- 2021: 8,936

- 2020: 9,813

Price Reductions:

Sellers who haven’t attracted much interest to their listing in 30 days are urged to consider adjusting their price. The number of price reductions is down by 3.5% when compared to September 2021.

-

- 2022: 871

- 2021: 903

- 2020: 960

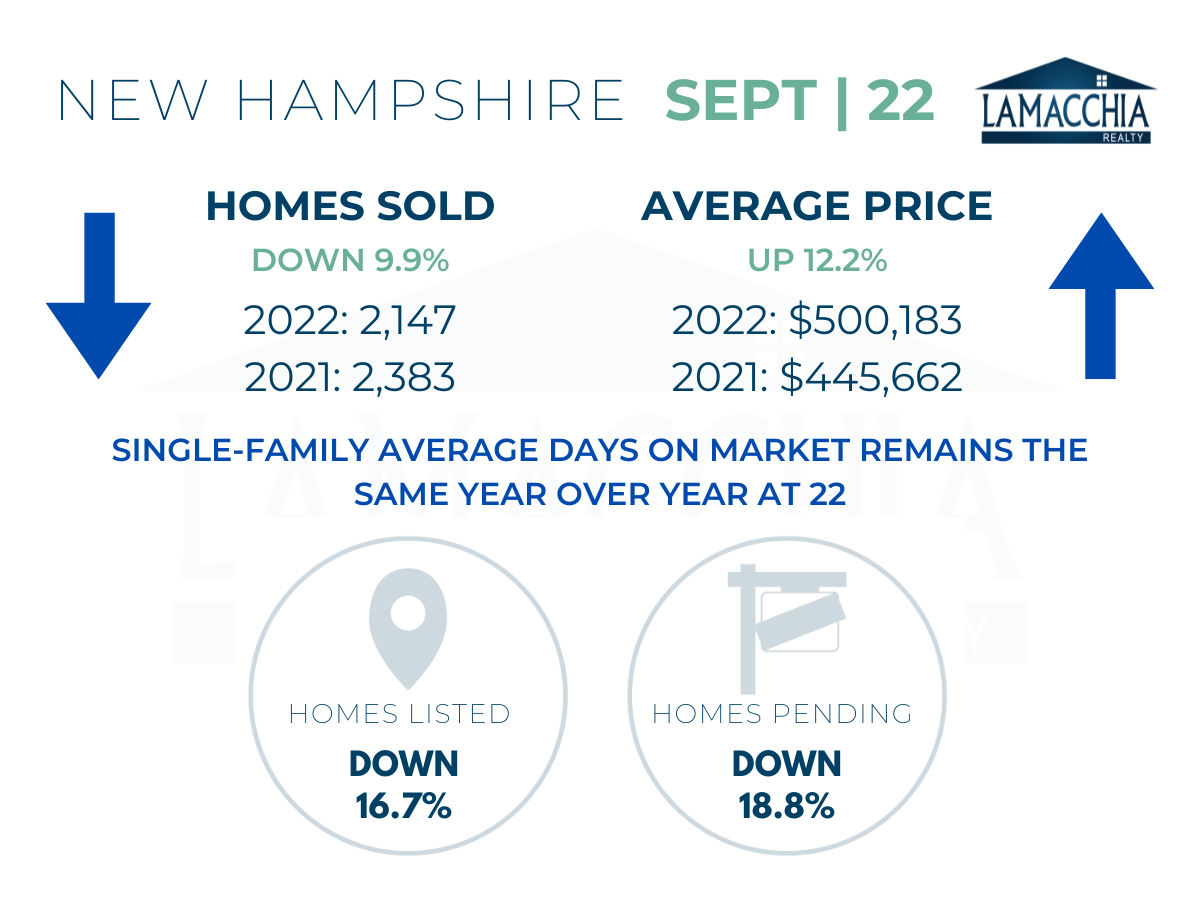

New Hampshire Home Sales Down 9.9%

New Hampshire Home Sales Down 9.9%

Single-family, condo home sales, and multi-family home sales have all decreased overall by 9.9% when compared to September 2021.

- Single families: 1,763 (2021) | 1,588 (2022)

- Condominiums: 474 (2021) | 473 (2022)

- Multi-families: 146 (2021) | 86 (2022)

Prices overall have continued to increase, now up 12.2% to $500,183 compared to September 2021. Prices increased in every category.

- Single families: $482,311 (2021) | $533,018 (2022)

- Condominiums: $326,155 (2021) | $392,326 (2022)

- Multi-families: $391,100 (2021) | $487,081 (2022)

Homes Listed for Sale:

The number of homes listed is down by 16.7% when compared to September 2021.

- 2022: 2,052

- 2021: 2,462

- 2020: 2,868

Pending Home Sales:

The number of homes placed under contract is down by 18.8% when compared to September 2021.

- 2022: 1,910

- 2021: 2,352

- 2020: 2,923

Highlights

- Sales are falling when compared to the frenzy of last year, but that frenzy made 2021 an outlier year and would make any strong market seem like it’s decelerating. Context is key.

- Prices are up year over year but are not as high as they were on average a few months ago, so this is prime time to make an offer.

- Heightened interest rates continue to keep many potential buyers out of the market, as affordability is crunched. This is giving inventory a chance to catch up which is a good thing! This lessening in buyer urgency, and therefore competition, gives active buyers more choice, time, and a break from the market of the beginning of the year which was saturated with bidding wars, paying over-asking and waiving contingencies.

- Marry the house, date the rate! Buy now, get the house you want and need, and if rates drop, refinance! Better to buy and pay your own fixed mortgage than rent and pay someone else’s!

- There are countless benefits to home ownership, but there are four main benefits you shouldn’t overlook when deciding if you want to buy your own home.

- Sellers, when pinpointing a target list price when placing your home on the market, be advised that the methodology of using Comps has evolved. Gone are the days of using a similar home sold 6 months ago as the market has shifted significantly in that time frame, click here to learn more.

- Rates in September have risen over 7% once again, significantly impacting buyer affordability. Now is the time to be reasonable when pricing your home. Overpricing it now will only make it sit longer and likely require an eventual price adjustment to attract more buyers.

- Even though there is a lessening of demand, this does not translate to cheaper housing. Inventory levels, although rising, are still too low to drive prices down (i.e., supply is too low). However, the rate in which home prices have been increasing will slow as more inventory gets added to the market, a trend we are already seeing evidence of and is expected to continue as the year rolls on.

Data provided by Warren Group & MLSPIN for MA, and by NEREN for NH then compared to the prior year.