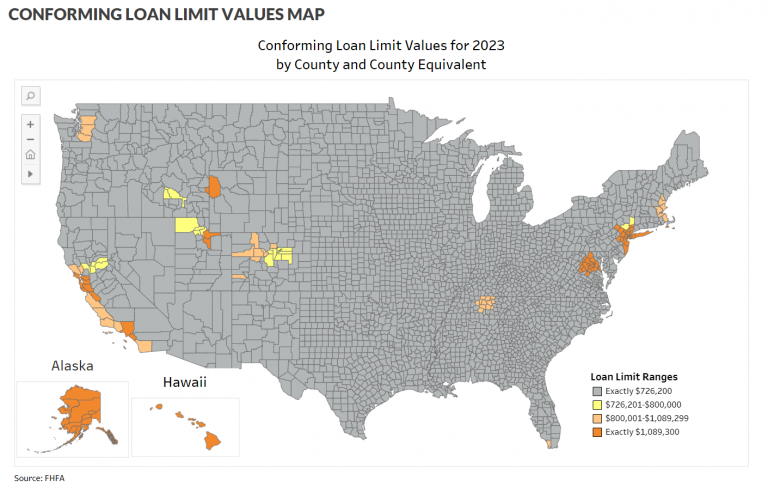

FHFA announced today that the conforming loan limits (CLLs) will rise by $79,000 from $647,200 in 2022 to $726,200 in 2023 for single-family/one-unit properties. These higher limits are propelled by average prices for homes which have increased by over 12% in 2022 due to high demand and limited supply. Based on county-equivalents, eastern Massachusetts has a higher loan limit of $828,000 while Nantucket and Martha’s Vineyard are at the high-cost area level.

High-cost areas, where 115% of the median home value is higher than the loan limit, will rise to $1,089,300- the first time ever that the limit has exceeded a million dollars.

Click on the map below to view the FHFA Loan Limit Values map:

“Mortgages within the limits are called conforming loans, and they generally come with lower closing costs and can require a smaller down payment than mortgages that exceed the limit, known as jumbo mortgages.” The WSJ covered the loan limit increase, for which Anthony Lamacchia was featured: “Mortgage bankers and real-estate agents say the new limits are needed to reflect higher home prices. Fannie and Freddie’s loan limits “need to keep pace with home prices to address affordability,” said Anthony Lamacchia.”

The annual adjustment in loan limits has increased every year since 2016, before which there wasn’t an adjustment for 10 years.