Sellers and their agents use comps to help determine a proper list price for a property. Closed comparable sales, also known as ‘comps,’ are used to approximate market value for residential properties. To determine what is comparable, one must consider all the physical attributes of a home including location, style, size, age, condition, amenities, upgrades, number of bedrooms and bathrooms, etc. As well, there is one non-physical consideration to consider, and that is time since the property sold.

Sellers and their agents use comps to help determine a proper list price for a property. Closed comparable sales, also known as ‘comps,’ are used to approximate market value for residential properties. To determine what is comparable, one must consider all the physical attributes of a home including location, style, size, age, condition, amenities, upgrades, number of bedrooms and bathrooms, etc. As well, there is one non-physical consideration to consider, and that is time since the property sold.

All else being equal, the more recent the sale is, the more weight should be placed on the comp’s value. Historically, in a balanced market, comps sold within six months were acceptable to use. As the market gained momentum since the pandemic and homes began selling in a matter of weeks, if not days, a short timeframe of within 3 months became the acceptable level.

Comps in the Post-COVID Market

In this market, a seller looking at comps to pinpoint their own target list price must be a little savvier than in years past. The market dynamics are changing quickly and drastically in this post-COVID world.

Depending on how recently an individual property sold, it is not uncommon that time impacts the validity of the comps as the market changes. Often these changes are due to seasonal patterns but could also be related to economic factors such as what we are seeing now; rates rising, buyer affordability changes, consumer sentiment impacting motivation to buy or sell, and inflation. These factors impact supply and demand and therefore how much a buyer is willing or able to pay for a home.

That’s why comps are based on closed sales and what the buyer paid, not active listings and what the seller listed it for. Market value is determined by sales, not the high hopes of a seller.

Time and Comps

It typically takes 30-60 days for a property to go from under contract to closed. The market has continually changed in most cases from when the property closed to when the comps are pulled. For example, say a property closes in mid-March, that would mean it was probably listed in January when there were very few homes on the market, many more buyers competing for the property, and in the instance of 2021, mortgage rates were in the 3% range. The buyer made an offer, likely underwent a multiple offer bidding war, and eventually negotiated a deal where the seller accepted an over-asking sale price.

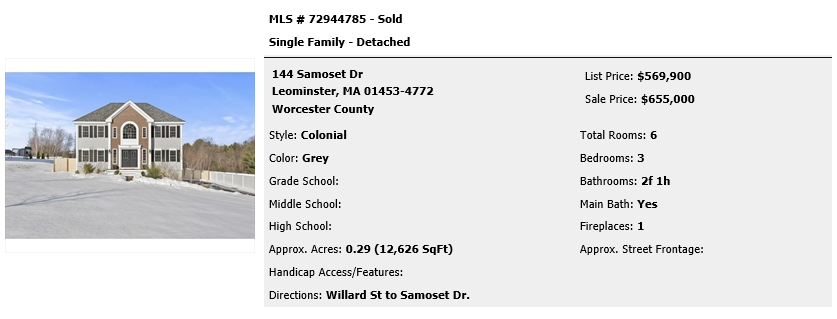

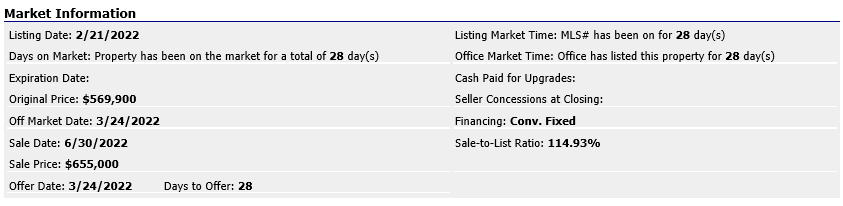

Take this home for example. Earlier this year, the property went on the market and in just 28 days, came off the market and sold for well over the asking price. Competition was high, inventory was low, and there were bidding wars happening everywhere. This home sold for $85,000 over asking which is immensely reflective of the market conditions during that time.

Three months later, a seller four blocks away pulls comps to determine their list price to list in June, the closed property comes up due to similar characteristics, condition, size, etc, and sees the sale price and thinks, great I’ll list my house for that. Right?

Not necessarily. You have to think about the June market. Now, it’s the opposite of the January set of circumstances in that there are fewer buyers competing and outbidding each other, rates are almost twice what they were in January now in the 6-7% range, inflation is through the roof, and all these factors are diminishing what a buyer can afford. If the June seller lists their home at the January premium, their home will likely sit on the market without much interest, and then a price reduction would likely be in order.

Within that same buyer pool looking for a home in that neighborhood, near the school, with that number of beds, baths, and yard, some can no longer afford that list price. This is due to mortgage rates impacting what they have to put down and what their monthly payment will be for presumably the next 30 years (or until rates drop and they theoretically refinance).

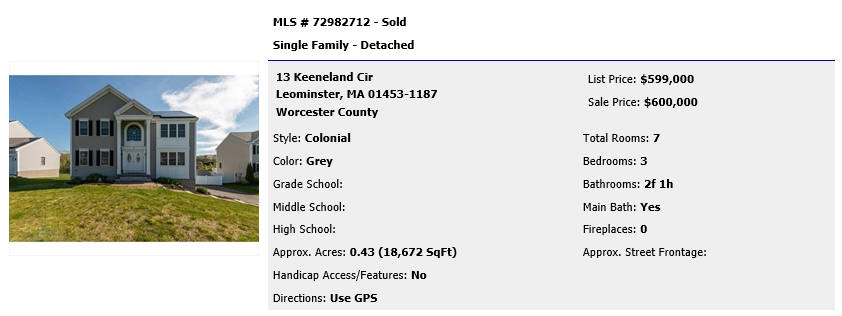

Here is an example. This home was listed on 5/17/22 for $599,000 and sold for just $1,000 more. During this time, there were more homes on the market, less buyer competition due to higher mortgage rates, and with inflation much higher than earlier in the year, buyers were able to afford less. This is much different from the January market example above, and something that sellers should keep in mind when they discuss sale price with their Realtor.

The smart seller will look at the January comp, take into consideration the changes the market underwent over the past three months and then price accordingly with their Realtor’s expertise informing them of best practices.

If we take that hypothetical and put it into reality, over the past 6 months, mortgage rates have risen significantly – from around 4.75% to around 7% today. This negatively affects the buyer’s purchasing power, by a lot! The general rule of thumb is that a 1% increase in the 30-Year rate results in an increase of 10% in the Buyer’s payment. So this 2% change decreased the buyer’s affordability by over 20%.

This brings us back to the important premise that although home sales prices are confirmed on the day the closing occurs, the market forces that were in effect at the time the sale was negotiated 30, 60, or even 90 days earlier have changed; and they have changed significantly over the past few months since the closing. Pulling comps is a necessary and appropriate step in helping to target a list price, and it also helps buyers understand what they can afford, but only if these comps are not taken at face value. They must be considered concurrently with the recent market fluctuations in order to provide the best guidance.

If you’re interested in learning more about what your home would sell for in this market, contact one of our Realtors today!