The Lamacchia Realty South Florida Housing Report presents overall home sale statistics and highlights the average sale prices for single families, condominiums/townhomes in Broward County, Miami-Dade County, and Palm Beach County for July 2022 compared to July 2021. It also looks at other metrics like New Listings and New Pending Sales as they are often the best indicators for predicting future trends in the market.

The Lamacchia Realty South Florida Housing Report presents overall home sale statistics and highlights the average sale prices for single families, condominiums/townhomes in Broward County, Miami-Dade County, and Palm Beach County for July 2022 compared to July 2021. It also looks at other metrics like New Listings and New Pending Sales as they are often the best indicators for predicting future trends in the market.

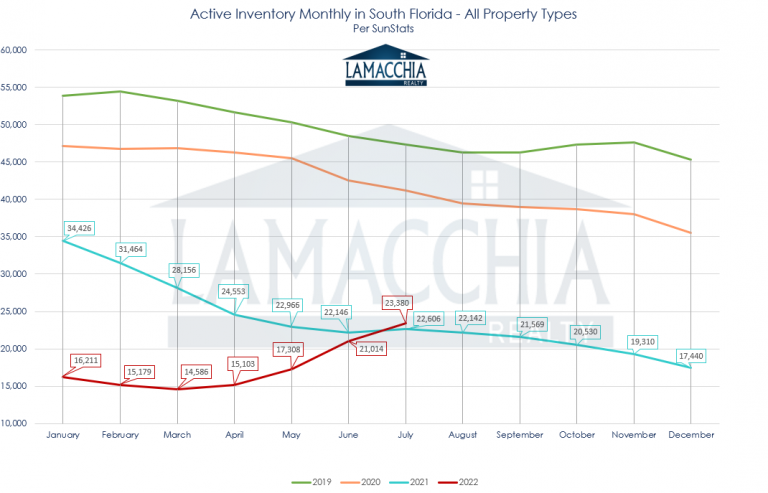

The inventory crisis last year caused supply to drop lower than ever by fall and into the winter, which in turn caused prices to continue to increase significantly with demand. Recent mortgage rate spikes have reduced affordability for buyers and have also slowed the price increase which has started to help inventory rise a bit giving buyers more selection.

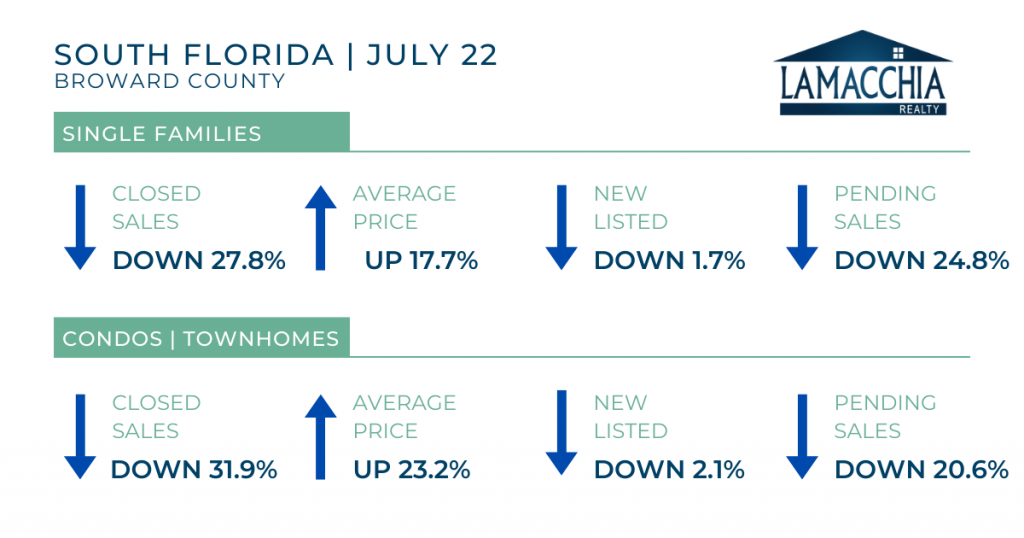

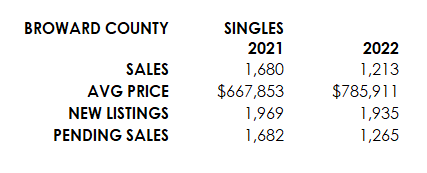

Broward County

Broward County single family and condo/townhome closed sales, new listings, and pending sales decreased. Average price increased in both property types.

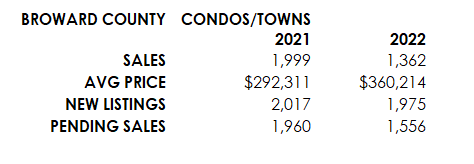

Miami-Dade & Palm Beach Counties

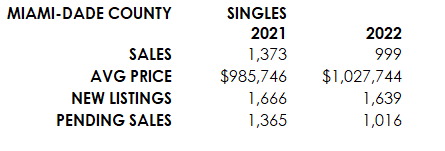

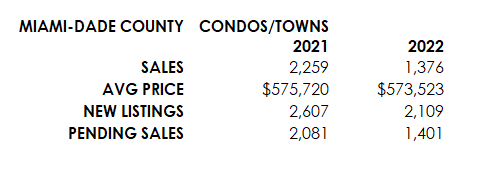

In July of 2022, Miami-Dade single families and condos/townhomes saw decreases in closed sales, new listings and pending sales. Average price for single family homes increased, but slightly decreased for condos/townhomes.

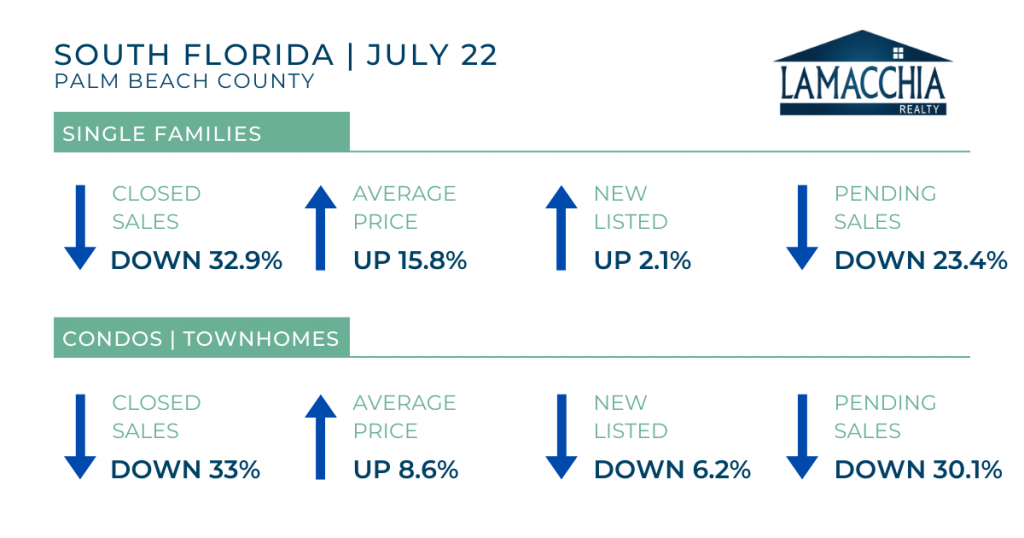

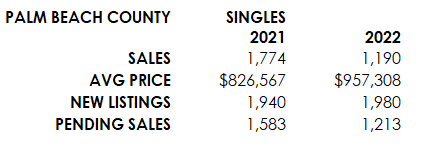

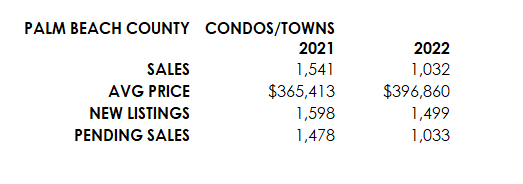

Palm Beach County single families and condos/townhomes saw a decrease in closed sales and pending sales and an increase in average price. However, new listings for single families increased slightly compared to condos/townhomes which saw a decrease in new listings.

South Florida Inventory

As predicted, South Florida inventory levels have continued their ascent, and have officially surpassed 2021 inventory levels in the month of July 2022. Increased mortgage rates have slowed the market and inventory is no longer being cannibalized by frenzied buyers which means the levels are likely to continue to rise as we continue throughout the year. Even though average price in July for single-families and condos/town homes increased, the increase was much less than in previous months, with condo/townhome prices even decreasing slightly this month in Miami-Dade County. As inventory levels keep increasing, home price appreciation is expected to continue to decelerate.

What’s Ahead?

The effects of increased mortgage rates can be seen in this month’s South Florida sales numbers which, when compared to July 2021, are down across all three counties in both single-family and condo/townhome categories. In addition to sales being down, pending sales are also down quite a bit again in July 2022 which indicates we will most likely see lowered sales numbers again in August 2022. On the rise are inventory levels, now surpassing 2021 levels, and are expected to continue their ascent back towards pre-pandemic levels as the year progresses. South Florida inventory may be increasing more rapidly than other parts of the country since South Florida is a popular 2nd home location. Now with the overall economy changing, 2nd homeowners may be opting to list their homes to release themselves of the financial burden which adds new listings to inventory. Additionally, as covid guidelines are lifted, more companies are requiring that employees return to offices to work on-site. Those who moved to South Florida during the pandemic may now have to sell and head back to where their work location is. With less employee mobility, this also means there will be fewer buyers in the South Florida market compared to the early years of the pandemic.

As inventory rises, price appreciation will begin to slow, and we may even see a decrease in prices eventually as a result. For July, average prices were still up in every county and category, besides Miami-Dade condos/townhomes which were down slightly, but much less so than months prior, demonstrating that the steep price increases we have been seeing in the market are already beginning to decelerate.

Despite slowing, prices are still rising and are historically higher when compared to pre-pandemic prices. This, coupled with high inflation and heighted mortgage rates, will continue to impact buyer affordability and demand in the months to come. However, buyers should be aware that there is a cost to ‘waiting for rates to come down’ and staying out of the market. Although buyer affordability is diminished, fewer buyers in the market (i.e., less demand) means that buyers will be facing less competition and finally have some more leverage with increased availability, lessening of bidding wars, etc. Additionally, when mortgage rates spiked, the rental market became quickly saturated with buyers who were unable to stay in the housing market, so demand for rentals is hiked up and the cost of renting along with it, so buyers should take the time to evaluate rent prices vs mortgage prices.

For sellers, pricing your home right is critical to stay competitive in this changed market to make sure your home sells quickly and for the most money. If you are a seller and your home is sitting on the market, the first thing to consider is a price adjustment. Overall, the real estate market is changing, not crashing, and there are plenty of ways to take advantage of the cooling market.

As mentioned above, condos and townhomes in South Florida are also feeling the effects of increased mortgage rates. For those looking to become condo owners in South Florida, it is also important to consider how new condo regulations in their decision as several have been put in place as a result of the tragedy in Surfside. Staying informed about these changes and how they affect your perspective complex/association will be key in making the decision that works best for you in the long run.

*Data provided by Florida Realtors® SunStats